The global trade environment in 2025 has reached a fever pitch of complexity. For tourism souvenir importers, wholesalers, and brand retailers, the days of “passive importing”—where you simply pay the invoice and hope for the best at customs—are over. With the sudden suspension of the de minimis threshold in the United States and the tightening of anti-dumping duties in the European Union, the tariff landscape is no longer a minor line item; it is a primary driver of profit optimization.

If you are sourcing bulk souvenir orders from a China souvenir factory, you are likely facing a multi-front battle: Section 301 reciprocal tariffs, material-specific duties, and increasing scrutiny on customs valuation.

This definitive guide, crafted by our SEO expert team, moves beyond basic “sourcing tips.” We are deploying the Skyscraper Technique to provide a deep, forensic analysis of the legal strategies available to you. We will explore tariff engineering, decode the First Sale Rule, and analyze how your choice of a manufacturing partnership can literally save you 25% or more on your landed costs.

The 2025 Reality: Why “Business as Usual” is a Margin Killer

The end of 2025 has brought structural shifts that have fundamentally changed the cost of the global souvenir supply chain.

The Death of De Minimis and the Rise of Reciprocal Tariffs

Historically, many small-to-medium wholesalers and e-commerce brand retailers relied on the $800 de minimis threshold to avoid duties on smaller shipments. As of late 2025, that loophole has effectively closed. All shipments now require formal entry and full HS Code classification, meaning every single unit of your custom souvenirs is now subject to the prevailing tariff rate.

Furthermore, with baseline reciprocal tariffs on Chinese goods hovering between 10% and 20%, and some categories facing “surge” tariffs of 40% or more, the landed cost analysis of a wholesale souvenirs order has never been more critical.

The Compliance Burden

Customs authorities (CBP in the US, TARIC in the EU) are now using AI-driven auditing tools to flag “misclassification.” If you are incorrectly labeling a resin souvenir manufacturer product as a lower-duty “plastic toy” to save 3%, you are no longer just risking a fine—you are risking a full supply chain audit and product seizure.

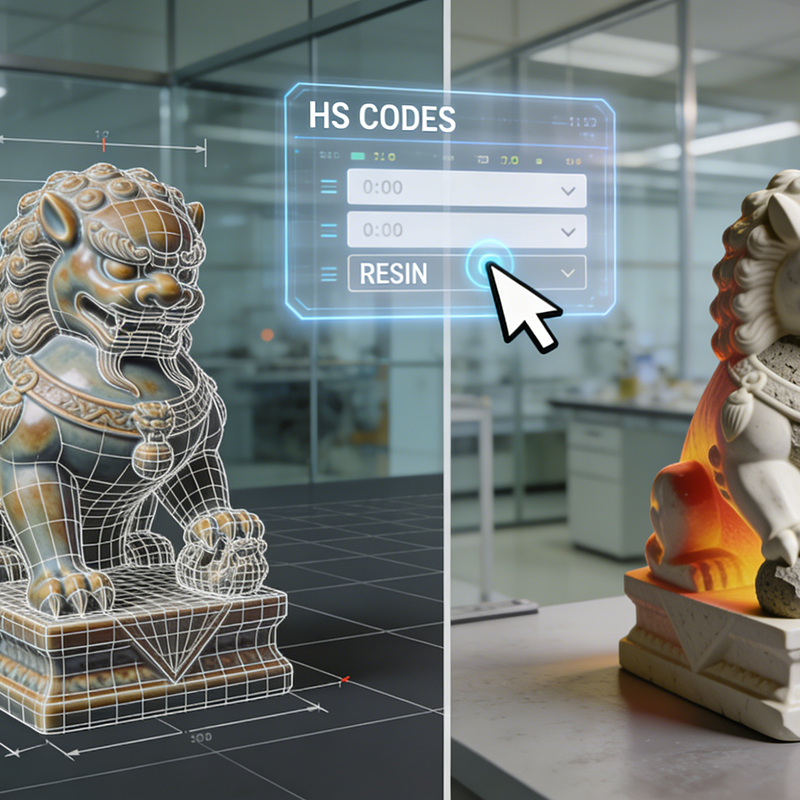

Strategic HS Code Optimization: The Art of “Tariff Engineering”

The most powerful tool in an importer’s arsenal is HS Code classification. The Harmonized System is not a static list; it is a complex language. Tariff engineering is the legal practice of designing a product specifically to fall under a lower-duty HTS category.

Material-Based Classification Shifts

For tourism souvenir importers, a slight shift in material composition can lead to a massive shift in duty rates.

- The Resin vs. Ceramic Divide: In many jurisdictions, ceramic souvenir production (Chapter 69) faces significantly higher duties—including heavy anti-dumping duties in the EU—compared to polyresin (Chapter 39). By working with a resin souvenir manufacturer like Craftmgf.com to replicate the look of ceramic using a stone-powder-and-resin mix, you can often trigger a 0-6% duty rate instead of a 15-35% rate.

- The “Utility” Loophole: A decorative figurine is a “statue” (high duty). A decorative figurine that also functions as a bottle opener or a magnet may be classified under “functional hardware” or “magnets,” which often carry lower baseline rates.

Case Study: Material Engineering for Duty Reduction

Consider a client importing 50,000 units of a landmark replica. By adjusting the weight of the base and shifting from a 100% ceramic build to a resin-based build with an iron-core for weight, we were able to reclassify the item.

| Product Type | Primary Material | HS Code | Typical US/EU Duty Rate | Anti-Dumping (EU) |

| Traditional Replica | 100% Ceramic | 6913.90 | 6.0% – 15.0% | Up to 79% |

| Engineered Replica | Polyresin/Stone Mix | 3926.40 | 3.3% – 6.5% | 0% |

| Functional Souvenir | Metal/Plastic | 8306.21 | 0.0% – 2.8% | 0% |

Note: Data is illustrative. Actual rates depend on the specific 10-digit HTS code and country of origin.

The “First Sale Rule”: Unlocking Valuation-Based Savings

For larger wholesalers and brand retailers, the First Sale Rule (FSR) is the “holy grail” of duty mitigation.

How the First Sale Rule Works

Normally, duties are calculated based on the price you pay to your supplier (the Transaction Value). However, if your supply chain involves a middleman or a trading company, the First Sale Rule allows you to declare the value of the goods based on the first sale—the price the manufacturer sold the goods for—rather than the price you paid the middleman.

- The Middleman Markup: A factory in China sells a bulk souvenir order to a trading company in Hong Kong for $1.00 per unit.

- The Final Sale: The trading company sells those same goods to you for $1.40 per unit.

- The Saving: Under FSR, you pay duty on the $1.00 price, not the $1.40 price. On a $100,000 order with a 25% tariff, this strategy saves you $10,000 in cash immediately.

Requirements for FSR Compliance

To successfully implement FSR, your manufacturing partnership must be transparent. You must prove:

- Bona Fide Sale: A legitimate transfer of title and risk occurred between the factory and the middleman.

- Arm’s-Length Transaction: The price was set by market forces, not artificial underpricing.

- Irrevocable Commitment: At the time of the first sale, the goods were clearly destined for export to your country.

At Craftmgf.com, we provide the transparent documentation (purchase orders, commercial invoices, and proof of payment) required for our clients to legally execute FSR strategies, directly supporting their profit optimization.

Navigating Anti-Dumping and Countervailing Duties (AD/CVD)

The most dangerous “trap” in the global souvenir supply chain is the Anti-Dumping duty. These are massive, punitive tariffs (often 50% to 200%) aimed at products that the government believes are being sold below cost to harm domestic industries.

High-Risk Souvenir Categories

- Ceramic Tiles and Tableware: China-origin ceramics are under heavy fire in both the US and EU.

- Aluminum Extrusions: Used in some high-end metal souvenirs and frames.

- Hardwood Plywood: Critical for some wooden souvenir lines.

Mitigation through “Scope Rulings”

If your product is flagged for AD/CVD, you can apply for a Scope Ruling. This is a legal request to customs to prove your specific custom souvenirs do not fall within the technical “scope” of the anti-dumping order. For example, a highly decorated resin souvenir manufacturer piece that contains some wood may be ruled as a “decorative handicraft” rather than “wood products,” exempting it from a 60% anti-dumping duty.

The Role of a Strategic Manufacturing Partnership

Tariff mitigation is not a task for your logistics department alone; it starts at the factory floor. A true China souvenir factory partner acts as a consultant, helping you navigate these waters.

1. Material Innovation

We work with tourism souvenir importers during the souvenir product development phase to select materials that offer the best “Duty vs. Aesthetic” ratio. For instance, using FSC-certified wooden souvenir China sources can sometimes unlock lower “green” tariffs in specific EU categories compared to non-certified sources.

2. Duty Drawback Programs

If you are a wholesaler who imports souvenirs into a hub (like the US or UAE) and then re-exports them to cruise ships or other international destinations, you may be eligible for a Duty Drawback. This allows you to claim a refund of up to 99% of the duties paid on the initial import. We provide the meticulous production and shipping records necessary to substantiate these claims.

3. Sourcing Diversification (The “China Plus One” Strategy)

While China remains the world’s most efficient wholesale souvenirs hub, some clients are exploring “China Plus One.” A professional partner like Craftmgf.com can assist in managing complex supply chains where components are produced in China but final assembly or significant transformation occurs in a secondary location to potentially change the Country of Origin (COO)—though this must be done with extreme legal caution to avoid “transshipment” penalties.

Conclusion: Turning Tariffs into a Competitive Edge

In the 2025 trade environment, the tourism souvenir importer who understands tariffs will always outperform the one who only looks at the unit price. By utilizing tariff engineering, leveraging the First Sale Rule, and choosing a transparent manufacturing partnership, you can significantly reduce your landed cost analysis and reinvest those savings into marketing and product expansion.

The “landscape” is shifting, but for the informed wholesaler, every new tariff is simply another variable to be optimized. Compliance is your foundation; strategic classification is your weapon.

Are your current souvenir margins being eroded by unexpected import duties? Contact Craftmgf.com today for a comprehensive Landed Cost & Tariff Analysis. Let our experts help you optimize your HS codes and explore legal valuation strategies to protect your profit optimization.

- AQL 2.5 vs. 4.0: Defining Acceptable Defect Thresholds for Mass-Produced Tourist Magnets - January 28, 2026

- The Importer’s Guide to Total Landed Cost (TLC): Calculating the Real Price of Resin Souvenirs from Quanzhou - January 21, 2026

- Eco-Friendly Manufacturing Practices: Our Commitment to Biodegradable & Low-VOC Production - January 14, 2026