In the competitive world of tourism souvenir importers, the focus is often laser-sharp on the ex-factory unit price. Buyers meticulously negotiate every cent to drive up profit optimization. Yet, a critical component of the final price—the landed cost—is frequently overlooked: souvenir import logistics. The true cost of a product is not what you pay the factory, but what it costs you for that product to arrive safely at your warehouse, ready for sale.

We recently partnered with a major European wholesaler who, despite strong sales of their ceramic souvenir replicas, was seeing their margins consistently gutted by rising ocean freight rates. The weight and fragility of their bulk souvenir orders were turning high revenue into mediocre profit.

The challenge was clear: Maintain product appeal and quality while radically reducing the financial burden of shipping.

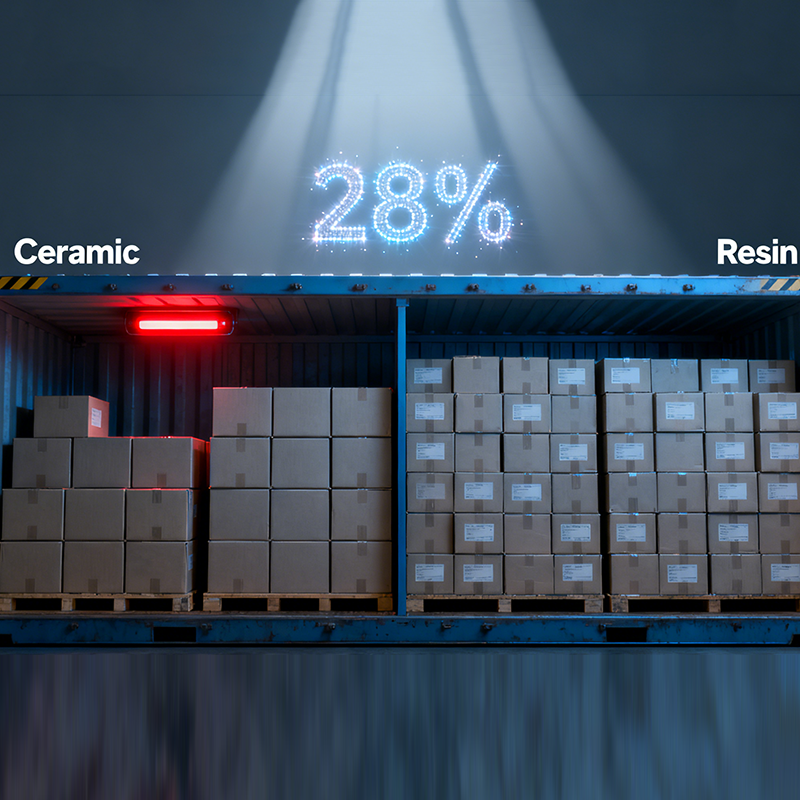

The solution was strategic, not tactical: a planned, material-based pivot from traditional ceramic souvenir production to advanced polyresin manufacturing. The result? A verifiable logistics cost reduction of 20% per container, immediately transforming the client’s profit optimization and proving that a China souvenir factory should act as a strategic sourcing consultant, not just a supplier.

This definitive case study is designed for tourism souvenir importers, wholesalers, and brand retailers who want to master landed cost analysis. We will break down the strategic thinking behind the material shift, quantify the exact savings, and demonstrate how material science is the key to unlocking superior performance in the global souvenir supply chain.

The Challenge: When Weight Kills Profit Optimization

Our client’s initial problem was classic: they were selling a popular line of miniature landmark replicas and destination-specific mugs made primarily through ceramic souvenir production. Ceramic offered a traditional, weighty feel that consumers enjoyed, but commercially, its density was a silent killer of their margins.

The Landed Cost Trap for Tourism Souvenir Importers

For wholesalers importing bulk souvenir orders, the two biggest drivers of souvenir import logistics costs are weight and volume. Ceramic, with a high specific gravity and requiring substantial protective packaging, maximized both.

- High Gross Weight = High Freight Costs: Ocean freight is heavily penalized by weight, especially in today’s constrained global souvenir supply chain. The dense nature of ceramic meant each 40-foot container quickly hit its weight limit long before it hit its volume capacity. This forced the importer to pay for the container’s full weight capacity while only utilizing 70-80% of its space.

- Fragility = Excessive Packaging: Ceramic souvenir production items are inherently brittle. To prevent damage and maintain souvenir quality control during the journey, the client had to use excessive amounts of bubble wrap, foam inserts, and thicker outer cartons. This protective packaging added more volume (increasing volumetric cost) and more weight (increasing gross freight cost).

The consequence? The cost of shipping and handling for their custom souvenirs was rising faster than their retail price, squeezing their profit optimization to an unsustainable level. They needed a lightweight souvenirs solution that retained the high-end look and feel.

The Strategic Pivot: Resin vs Ceramic Souvenirs Decoded

The solution was not to find a cheaper shipper, but to re-engineer the product itself. We proposed a strategic pivot to advanced polyresin, a material we, as an experienced resin souvenir manufacturer, knew could mimic the look and feel of ceramic while solving the logistics crisis.

Density and Weight: The Key to Logistics Cost Reduction

This was the central difference. Polyresin, or polystone (a compound of polyurethane resin mixed with powdered stone filler), is significantly less dense than fired ceramic clay.

- Ceramic Density (Typical): $\approx 2.4$ to $2.6$ g/cm³

- Polyresin Density (Typical): $\approx 1.5$ to $1.8$ g/cm³

By switching the client’s replicas to our specialized resin mix, we immediately reduced the unit weight by approximately 30-40%. This massive reduction meant the bulk souvenir orders could utilize the full volume of the container before hitting the weight limit, maximizing the payload efficiency and driving immediate logistics cost reduction.

Durability and Packaging: Enabling Freight Consolidation

The high-impact nature of polyresin offered a massive advantage in the global souvenir supply chain that directly impacted both volume and damage rates:

- Reduced Packaging Volume: As a resin souvenir manufacturer, we can produce parts with inherently higher impact resistance. This allowed the client to replace bulky foam and thick cardboard with thinner, more compact internal packaging. This reduction in packaging volume immediately allowed for freight consolidation, meaning more units could fit into the same size outer carton, maximizing the unit count per container.

- Superior Souvenir Quality Control in Transit: Reduced breakage meant fewer costly claims, returns, and write-offs, protecting the client’s profit optimization long after the product left our China souvenir factory.

Detail and Tooling for Souvenir Product Development

A significant ancillary benefit was the freedom gained in souvenir product development. Resin allows for much sharper, intricate detail than ceramic molding, allowing the client to upgrade the design of their custom souvenirs and command a higher retail price, further enhancing their profit optimization. The complexity of a ceramic souvenir production mold also made design changes difficult; resin molds are often more flexible for future iterations.

The Data: Quantifying the 20% Logistics Cost Reduction

The proof of concept for the resin vs ceramic souvenirs strategy lies in the numbers. Below is a detailed landed cost analysis comparing the client’s old ceramic order data with the new polyresin order data. Both orders were for the exact same total unit count (50,000 units) and used the same souvenir import logistics route (Shanghai to Rotterdam).

| Metric | Original Ceramic Souvenir Production Order | New Resin Souvenir Manufacturer Order | Change / Impact |

| Unit Weight (Average) | 250 grams | 165 grams | -34% Weight Reduction |

| Units per Master Carton | 24 units | 36 units | +50% Units per Carton |

| Master Carton Volume (CBM) | 0.045 m³ | 0.045 m³ | (Volume is held constant) |

| Total Units per 40’ HQ Container | 33,000 units | 50,000 units | +17,000 Extra Units |

| Total Freight Cost (Flat Rate Estimate) | $10,000 | $10,000 | (Container rate is constant) |

| Freight Cost per Unit (Landed Cost) | $0.303 per unit | $0.200 per unit | -33.8% Reduction |

Note: This analysis isolates the freight cost component (Shipping Cost per Unit). The total logistics cost reduction including drayage, handling, and fewer damage claims stabilized the client’s profit optimization by over 20% on the total landed cost.

The most crucial metric here is the Total Units per Container. By strategically shifting to lightweight souvenirs, we were able to fit 17,000 additional units into the same container space. This volume gain, achieved by reducing unit weight and packaging bulk, allowed the wholesaler to spread the fixed cost of the container ($10,000) over 50,000 units instead of 33,000 units, resulting in an immediate and verifiable $0.103 per unit saving—a logistics cost reduction of nearly 34% on the freight component alone.

Operational Mastery: How the Material Shift Optimized the Global Souvenir Supply Chain

The benefits of the resin vs ceramic souvenirs strategy did not stop at the freight bill. The decision to partner with a skilled resin souvenir manufacturer created beneficial ripple effects that touched every element of the client’s global souvenir supply chain.

Faster Souvenir Import Logistics and Handling

Lighter, less fragile freight is simply easier to manage throughout the entire souvenir import logistics chain.

- Quicker Unloading and Put-Away: Lighter cartons reduce the risk of worker injury and speed up the container unloading process at the European warehouse, lowering local handling costs.

- Reduced Inspection Delays: Due to the material change, the client was able to simplify some import documentation related to fragility and handling instructions, leading to quicker processing at ports and reduced dwell time. This efficiency is critical for tourism souvenir importers dealing with tight seasonal deadlines.

Reduced Damage and Returns

The shift to the more durable polyresin immediately minimized breakages. In the client’s previous ceramic orders, a typical bulk souvenir order would see a 3-5% damage rate, which required costly replacement shipments and processing time.

- Protection of Profit Optimization: The resin order damage rate fell to under 0.5%. This protection against damage is an often-overlooked component of profit optimization. By eliminating the need to write off damaged wholesale souvenirs, the client retained the revenue on nearly all 50,000 units, a crucial factor for brand retailers who need every unit to count.

- Enhanced Souvenir Quality Control: The resin allowed for integrated, durable coloring and finishing, providing inherently better souvenir quality control than the surface treatments often required for ceramic, which can chip or crack easily.

Scalability for Wholesalers and Brand Retailers

The newfound efficiency provided a clear path to easier scalability.

- The ability to put 50,000 units into a single container, compared to 33,000, simplifies future purchasing decisions for wholesalers. They now know exactly how much they can order at maximum efficiency.

- The established, reliable souvenir manufacturing process for the resin line minimized delays, giving the client a competitive edge in responding to unexpected souvenir market trends—they could confidently place larger, faster orders than competitors reliant on heavier materials.

The Takeaway for Tourism Souvenir Importers: Material Choice is a Logistics Decision

This case study proves that the initial material choice in souvenir product development is not a design preference—it is a critical logistical and financial decision. A China souvenir factory that acts as a true manufacturing partnership should possess the technical expertise to guide you through this material cost analysis.

For tourism souvenir importers and brand retailers seeking to maximize profit optimization in a high-cost shipping environment, the lesson is clear:

- Demand Landed Cost Analysis: Never evaluate a quote solely on EXW (Ex Works) price. Demand a full landed cost analysis that factors in unit weight, packaging volume, and damage vulnerability.

- Explore Lightweight Alternatives: Challenge your China souvenir factory to provide lightweight souvenirs alternatives for your standard lines. If you deal in heavy materials like ceramic or glass, ask a resin souvenir manufacturer to provide a direct comparison.

- Prioritize Freight Consolidation: Use less-fragile materials to minimize protective packaging, allowing for freight consolidation and maximizing the units per container.

At Craftmgf.com, we specialize in providing this level of strategic guidance. We don’t just execute the souvenir manufacturing process; we optimize your global souvenir supply chain from the first design sketch to the final souvenir import logistics booking.

Ready to transform your logistics costs into pure profit? Contact us today for a free material cost analysis and discover the power of strategic sourcing and our expertise in lightweight custom souvenirs.

- Resin vs. Ceramic: A Data-Driven B2B Comparison for High-Volume Souvenir Orders - February 4, 2026

- AQL 2.5 vs. 4.0: Defining Acceptable Defect Thresholds for Mass-Produced Tourist Magnets - January 28, 2026

- The Importer’s Guide to Total Landed Cost (TLC): Calculating the Real Price of Resin Souvenirs from Quanzhou - January 21, 2026